The CTF levy portal is an online service that allows project owners to pay the Building and Construction Industry Training levy.

Anyone who needs to pay the Building and Construction Industry Training levy can sign up for the portal. This may include owner-builders, registered builders, contractors, state government agencies, and any person or company requiring building or construction work.

You can create an account by signing up to the portal. Please click on the “Sign up now” link to begin.

You will need an email account. If you are acting on behalf of a company, you will need basic information about your company such as the company name and ABN number. The information you provide may be used as part of our verification processes.

Below are some helpful guides for using and registering in the portal:

CTF Levy Portal Registration: Portal Registration Guide (PDF)

CTF Levy Guide: Levy Process Guide (PDF)

LGA Levy Process: LGA Levy Process (PDF)

Please try looking in your email’s spam folder or resend the verification code.

If it still doesn’t come through, please contact us.

If you are a new contact for an existing company, we are in the process of verifying your sign up with the primary contact in your company. This process may take up to 3 working days.

If your company has not setup an account with us, we are in the process of setting up the account for your company. This process may take up to 3 working days.

If you are an owner-builder, please contact us.

Please click on “Forgot your password” and follow the steps to reset your password.

If you’ve forgotten your user name or the email address you use to login, please contact us.

The project number is any unique alphanumeric (a mixture of text and numbers) series of characters for your internal reference.

- Residential sector refers to construction work on or resulting in a building that is intended to be used predominantly for residential purposes.

- Commercial sector refers to construction work on or resulting in a rigid fixed structure that is intended predominantly for the use of or to contain people, plants, machinery, goods, or livestock; and that is not civil work.

- Civil sector refers to construction work on or resulting in

- a road, railway, airfield or other structure for the passage of persons, animals or vehicles; or

- a breakwater, dock, jetty, pier, wharf or other structure for the improvement or alteration of any harbour, river or watercourse for the purposes of navigation; or

- any structure for the storage or supply of water or for the irrigation of land; or

- any structure for the conveyance, treatment or disposal of sewage or of the effluent from any premises; or

- a structure for extracting, refining, processing or treatment of heavy industry materials or for the production or extraction of heavy industry products and by-products from materials; or

- a bridge, viaduct, aqueduct or tunnel; or

- a chimney stack that is not part of a residential or commercial building, a cooling tower, drilling rig, gas holder or silo; or

- a pipeline; or

- a navigational light, beacon or marker; or

- a structure for the drainage of land; or

- a structure for the storage of liquid or gas; or

- a structure for the transmission of wireless or telegraphic communications; or

- a fence, other than a fence on a farm; or

- a grandstand, stadium or swimming pool; or

- a structure for the generation, supply or transmission of electric power; or

- work for the preparation of sites for residential, commercial, civil or resources sector works or buildings.

- Resources sector refers to construction work that results in a building or structure that is used for resources operations that isn’t on, results in, or otherwise relates to a residential or commercial facility; a more detailed explanation can be found in this guide.

Find out more about Resource Sector Guidelines.

The record / project will be marked as paid once the payment is reconciled by our finance department. While this usually happens within 24 hours, it may take up to 3 working days.

If it has been 3 working days since you’ve made payment, please contact us.

You can try different search parameters. If you have more than one record/project page showing, ensure that you scroll through the pages to search.

If not, please contact us and we will be able to help you.

You can only change the details before the payment status is Billed or Paid (meaning levy payment request or tax invoice is sent to you or been paid). Simply select the project and click on the “Edit” button on the top right.

Please contact us if you need to change the details on your record/project after the levy payment request or tax invoice has been sent to you or been paid.

You can only change the details before the payment status is Billed or Paid (meaning levy payment request or tax invoice is sent to you or been paid). Simply select the project and click on the “Edit” button on the top right.

Please contact us if you need to change the details on your record/project after the levy payment request or tax invoice has been sent to you or been paid.

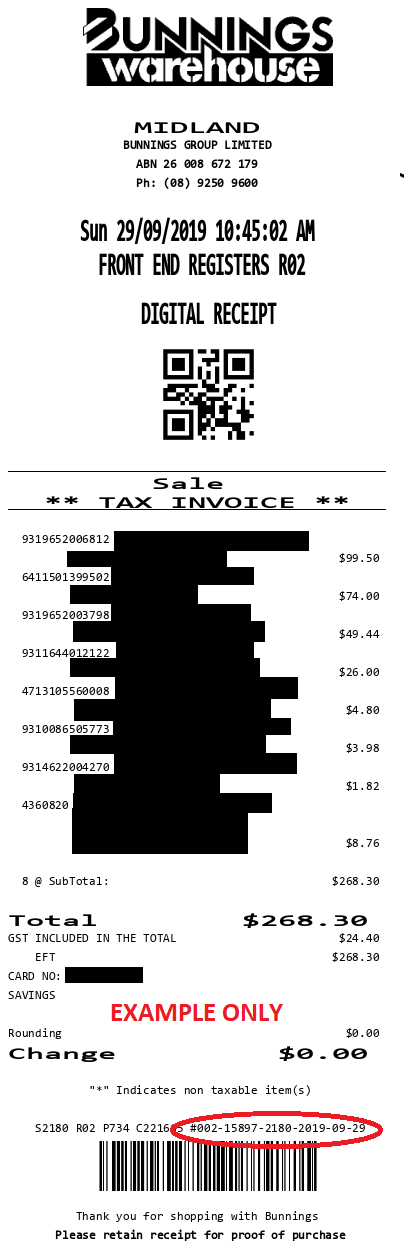

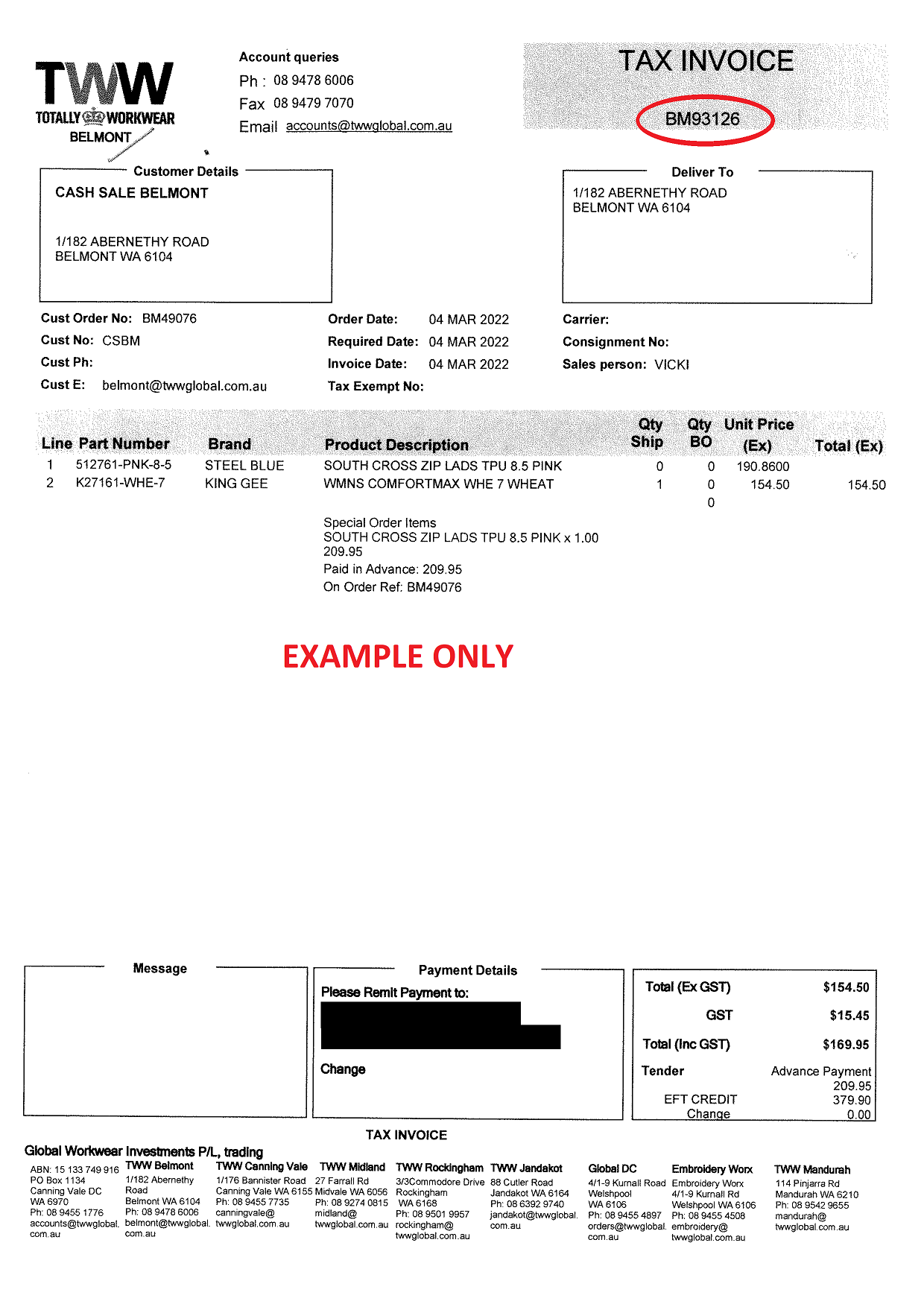

You can pay the levy through the CTF Portal. Payment is accepted via credit card or Electronic Fund Transfer (EFT). We do not accept cash payments and we are unable to take payments over the phone.

You may also pay the levy at your Local Government office. Some Local Governments collect the levy on our behalf as part of the building permit application process.

You should receive your CTF levy receipt within three business days of the payment date and time.

If you paid by credit card, you will receive a credit card transaction receipt within a few minutes of payment. This transaction receipt along with the levy payment request or tax invoice may be used as proof of payment for permit applications.

You can report the final construction value through the CTF Portal. Ensure that you include GST when providing the final construction values.

Click on the record/project, select “Edit” and fill in the final construction values.

If the final construction value varies by more or less than $25,000 from the estimated value, you must report the final construction values. An additional levy amount may be payable or refundable.

If the payment status of the record is “New” (meaning the levy payment request or tax invoice has not been sent to you and has not been paid), you can delete the project by selecting it, clicking the “Edit” button on the top right, then scroll to the bottom of the form and select the “Cancel Project” button.

If you are unable to do so, please contact us and we will assist by removing the duplicate record/project. If there has been a duplicate payment, we will provide advice on receiving a refund.

Please contact us using the “Query” button in the record/project and we will provide advice on receiving the refund.

To verify your account please contact CTF via info@ctf.wa.gov.au or call (08) 9244 0100 between office hours 8.30am – 4.30pm. We will send/ask you a variety of questions to confirm your identity and apprentice/traineeship contract.

If you do not have a pending payment, you can update your details on the profile page on the Apprentice Portal.

The project owner pays the levy.

The project owner is defined as:

- The person or organisation that holds a building permit in respect of the construction work; or

- The person or organisation that is issued a contract to carry out the works; and/or

- The person or organisation receiving direct benefit from the construction work.

Where the government authority has contracted all the work (including goods, labour, fees, services, etc) a person or company to perform, the person or company contracted is responsible for paying the levy.

There may be instances in which a government authority assumes the responsibility for paying the levy; if you are undertaking building and construction work on a government contract, please speak to your contact about the levy.

The levy does not apply to government work undertaken by government employees or officers.

Yes, the levy applies even if a building permit is not required.

Where the levy applies but a building permit is not required, the project owner must notify CTF of the work and it’s estimated value and pay the levy before any construction work starts.

Penalties may apply if the construction work starts prior to payment of the levy.

You can pay the levy through the CTF Portal. Payment is accepted via credit card or Electronic Fund Transfer (EFT). We do not accept cash payments and we are unable to take payments over the phone.

You may also pay the levy at your Local Government office. Some Local Governments collect the levy on our behalf as part of the building permit application process.

The levy must be paid prior to commencement of construction, including any forward works, civil works or site preparation works.

If a building permit is required, the levy is paid prior to or at the time of building permit application.

You may need to pay additional levy when the building or construction work is completed.

If the final construction value varies by $25,000 or more than the estimated construction value, the project owner must report and pay the levy on the additional value of construction work.

If the final construction value varies $25,000 or more less than the estimated construction value, we will refund the levy on the value of construction work over estimated.

We may request for additional documentation and evidence to verify the final value of construction work.

Please refer to the Building and Construction Industry Training Fund and Levy Collection Act 1990 Section 27.

Building and construction work (according to the Act) is all of the work that is carried out in the state of Western Australia that is in the construction industry as defined in the Construction Industry Portable Paid Long Service Leave Act 1985 or that is building work or demolition work as defined in the Building Act 2011 section 3.

The definition of building and construction work includes work for "construction, erection, installation, reconstruction, re-erection, renovation, alteration, demolition or maintenance of or repairs" for the residential, commercial, civil and resource sectors.

If you are unsure if the work you are planning or undertaking constitutes building or construction work, please contact us.

The levy is applied at 0.2% of the estimated value of the construction work including GST.

The value of construction work must include value for the relevant components, which are all goods (including manufactured goods) used in the construction, labour, fees payable, services necessary, overheads to be met and profit margin.

If the building and construction work is carried out under a contract and the contract price includes value for at least each of the relevant components, then the value of construction work is the contract price (including GST).

If the building and construction work is carried out other than under a contract or if the contract does not include value for each of the relevant components, then the value of the construction work is the sum of the relevant components (including GST).

The levy calculation applies to reporting of the final construction value as well.

Please refer to the Building and Construction Industry Training Fund and Levy Collection Act 1990 Schedule 2.

GST must be included as a component of the estimated and final value of building or construction work.

The levy does not include a GST component as the levy is a government charge that is exempt from GST.

Any fees necessary for the close oversight, supervision, management or monitoring of the performance of the building and construction work must be included. Some examples include quality inspections for a residential building, safety inspections for a multi-storey commercial facility, and traffic management for roadworks.

This is subject to Building and Construction Industry Training Fund and Levy Collection Act 1990 Schedule 2.

If the building and construction work is carried out under a contract and the contract value includes each of the relevant components (per Building and Construction Industry Training Fund and Levy Collection Act 1990 Schedule 2), the total value of the project including GST is taken as the construction value. This may include costs that would otherwise be excluded.

Yes, contract variations must be included in the final construction value.

Please inform CTF of the new project owner details.

The new project owner will be liable for reporting the final construction value if there is a significant variance that results in additional levy or a refund.

If the building and construction work is cancelled after a new project owner is appointed, we cannot refund the levy. The levy can only be refunded to the original payee if the building and construction work is cancelled and will not be continued by a new project owner.

If work is carried out under more than one contract, the levy is paid on the total contract value including GST.

The Project Owner must ensure that the levy is paid on all the relevant components as per Building and Construction Industry Training Fund and Levy Collection Act 1990 Schedule 2, which includes:

- All goods (including manufactured goods) forming part of the construction work, and

- Labour, and

- Services necessary, and

- Fees payable, and

- Overheads to be met, and

- Profit margin.

Yes, the levy applies.

Any individual work order or work package undertaken within a panel contract or arrangement that is building and construction work and is over $20,000 is leviable.

This applies even if a work order or work package includes multiple sites.

Yes, the levy applies.

Any individual work order or work package undertaken within the contract that is building and construction work and is over $20,000 is leviable.

This applies even if a work order or work package includes multiple sites.

The levy does not apply to maintenance work that is minor in nature if it is undertaken by an organisation or person who is not substantially engaged in the building and construction industry.

Maintenance work that is minor in nature generally requires minimal control measures to manage risks, requires little or no pre-start preparation of the work area, and is small scale and often of short duration.

Some examples include:

- Inspection, testing and cleaning of an air-conditioning system, solar panels, or other such fixtures

- Replacing a water sprinkler but not installing or replacing the entire sprinkler system

- Replacing individual roof tiles but not an entire section

- Replacing individual toilets, cisterns, or taps

- Replacing individual security cameras but not the entire system

- Replacing a light globe, tube, or diffuser

Yes, it does if the estimated value of the construction works is above $20,000.

You would assume the role of the project owner and pay the levy based on all the relevant components as per Building and Construction Industry Training Fund and Levy Collection Act 1990 Schedule 2, which includes:

- All goods (including manufactured goods) forming part of the construction work, and

- Labour, and

- All goods (including manufactured goods) forming part of the construction work, and

- Services necessary, and

- Fees payable, and

- Overheads.

Yes, it does.

The levy applies to construction, erection, installation, reconstruction, re- erection, renovation, alteration, or demolition works for the fabrication, erection or installation of plant, plant facilities or equipment for buildings or works.

The levy also applies to structures, fixtures, or works for use on or for the use of any buildings or construction works.

This includes plant, plant facilities or equipment that has been manufactured outside Australia.

The levy does not apply to:

- Work that does not involve construction, such as cleaning, inspection, or testing and tagging of electrical equipment

- Construction work with a total estimated value equal to or less than $20,000 including GST

- Construction work undertaken by state or local government agency or instrumentality employees

- Agricultural work, unless a building permit is required

- Projects on foreign missions and consulates

- Soft landscaping

- Maintenance work on lift and escalators

- Arborist work

- Creating fire breaks

The project owner must keep records in relation to construction work for a period of 5 years from the commencement of work.

Refer to regulation 9 of the Building and Construction Industry Training Fund and Levy Collection Regulations 1991 for details of the information that needs to be kept.

When a project is valued at $500 million or more, you can pay the levy by instalments.

Please refer to this guide for more information.

You can report the final construction value through the CTF Portal. Ensure that you include GST when providing the final construction values.

Click on the record/project, select “Edit” and fill in the final construction values.

If the final construction value varies by more or less than $25,000 from the estimated value, you must report the final construction values. An additional levy amount may be payable or refundable.

The levy collected on construction work is invested back into WA’s construction industry to fund a range of programs and much more.

The levy is used to provide employer grants, subsidise skills training, support apprentices and trainee, run school-based programs to promote construction careers, and advocate for a diverse, future-ready workforce.

Find out more about each of these programs on our website www.ctf.wa.gov.au.

If you wish to re-send a Claim Confirmation email, go to the Claim List page, navigate to the Claim Type and select the mail icon

• buildings

• swimming pools and spa pools

• roads, railways, airfields or other works for the passage of persons, animals or vehicles

• breakwaters, docks, jetties, piers, wharves or works for the improvement or alteration of any harbour, river or watercourse for the purposes of navigation

• works for the storage, or supply of water or for the irrigation of land

• works for the conveyance, treatment or disposal of sewage or the effluent from any premises

• works for the extraction, refining, processing or treatment of materials or for the production of extraction of products and by-products from materials

• bridges, viaducts, aqueducts or tunnels

• chimney stacks, cooling towers, drilling rigs, gas holders or silos

• pipelines

• navigational lights, beacons or markers

• works for the drainage of land

• works for the storage of liquids (other than water) or gases

• works for the generation, supply or transmission of electric power

• works for the transmission of wireless or telegraphic communications; pile driving works

• structures, fixtures or works for the use on or for the use of any buildings or works listed.

• works for the preparation of sites for any building or works listed.

• fences, other than fences on farms.

• plant facilities or equipment for those buildings or works

Yes, it does. However, there are exclusions to specific resources operational work in regulation 3 of the Building and Construction Industry Training Fund and Levy Collection Regulations 1991. Please refer to this guide and contact us to have a discussion.

Find out more about Resource Sector Guidelines.